Client: Green Leaf Fuel | Industry: Bulk Fuel Distribution | Location: Northern Alberta

When you run an equipment-intensive business across the remote regions of Northern Alberta, the stakes are high, especially when you’re supporting critical industries with bulk fuel delivery.

For Green Leaf Fuel, a branded bulk agent for Cenovus Energy, operational continuity depends on reliable equipment and reliable financing.

And for years, Green Leaf Fuel had both — until they didn’t.

“We’re a very loyal company,” says Rod Veremy, owner of Green Leaf Fuel. “We had been using the same leasing company since we started in 2000. We weren’t looking for anything else.”

But that changed with one phone call — on Boxing Day, no less.

A Crisis Leads to a Connection

In the early 2010s, one of Green Leaf Fuel’s longtime customers was in financial distress and falling behind on payments. Unfortunately, this customer fell so far behind that Rod had no choice but to shut off their fuel access. That move, while necessary, risked shutting down the customer’s business altogether.

That’s when Ross Sten, CEO of Essex Lease Financial Corporation (ELFC), picked up the phone.

“Ross called me out of the blue and said he was going to get the fuel bill paid and keep the cards on. I’d heard that before, but he flew out the next day to show he was serious. And within weeks, the deal was done.”

That experience stuck with Rod, not just because of how quickly Essex acted, but because of how personally they treated the situation.

“Ross gave me his card and said, ‘If you ever need financing, let me know.’ I told him, respectfully, we weren’t looking for high-risk lending—we were in a good place. And he said, ‘We’re not just for high-risk deals. We do all kinds of financing.’”

When the Oil Crash Hit, Essex Delivered

Fast-forward a few years: Green Leaf had placed an order for new fuel tanks when the 2016 oil crash hit. Their primary lender, a bank, suddenly decided to withdraw all lending to the oil and gas industry.

Green Leaf was left with assets on order and no capital to complete the purchase.

“I remembered that conversation with Ross, and I gave him a call. He had our invoices paid as quickly as possible. That deal is what started our real relationship with Essex.”

Why Essex?

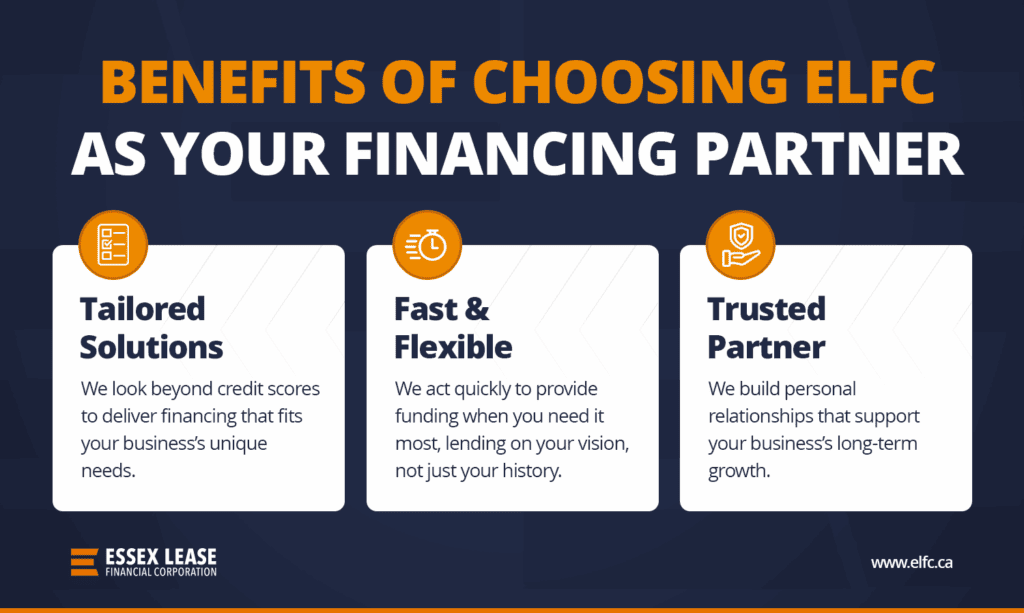

Green Leaf Fuel doesn’t just value fast financing; they value understanding. And that’s what they found in Essex.

“Essex really thinks outside the box. They take the time to understand the project you’re on and the rationale behind what you’re trying to do.”

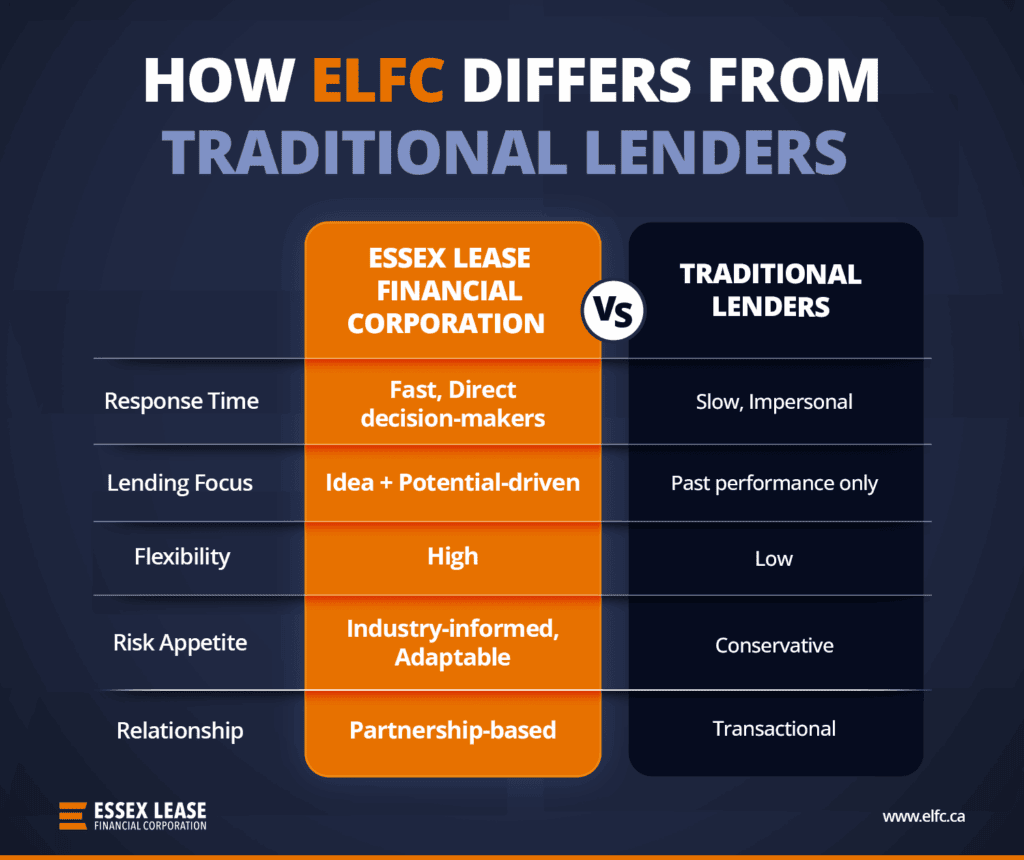

Unlike traditional lenders focused on rigid ratios and past performance, Essex takes the time to evaluate a business’s vision.

“The challenge is that you need the equipment to execute your idea, but you haven’t made the money yet. Essex will actually listen to your idea — and they’ll lend on the idea, not just the history.”

The Essex Approach

As a private, direct lender, Essex makes its own lending decisions — and it shows.

“They’ve got that family feel. They’ll actually sit down with you and figure it out. They know that if your business succeeds, they succeed.”

That trust and flexibility have made Essex one of Green Leaf’s primary financing partners. And it’s not a relationship they keep to themselves.

“We refer a lot of our friends, vendors, and clients to Essex. When someone treats you like a partner and not just a payment, that’s worth sharing.”

The Results

Since that first deal, Essex has supported Green Leaf Fuel’s continued growth through new equipment purchases, shifting markets, and period of industry uncertainty.

“Essex has been one of our primary lenders since that first deal. They’ve been there when we needed them most.”

Green Leaf’s story illustrates how having the right business loan in place at critical moments can keep a company on track for growth, even when other lenders pull back.

Are You Looking For a Financing Partner Who Truly Understands Your Business?

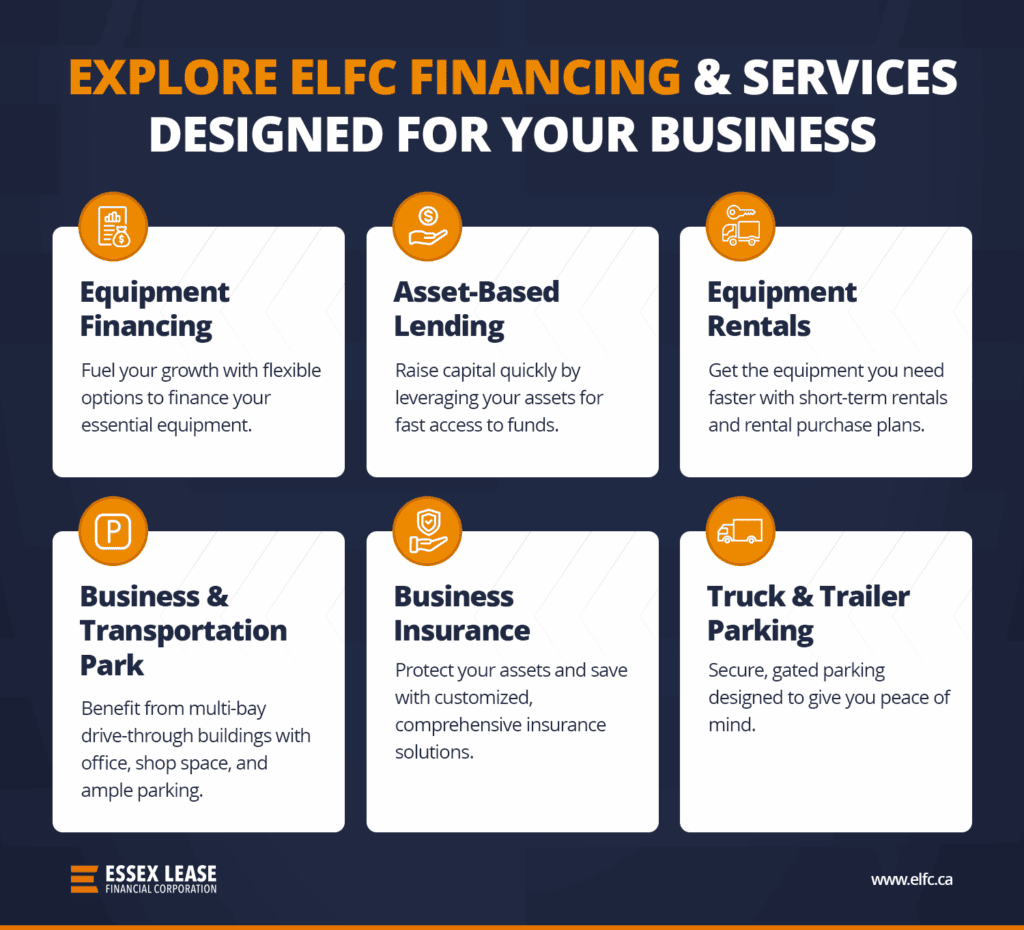

If your business needs a financing partner who understands your industry, acts quickly, and invests in your long-term success, we’re ready to help.

Contact Essex Lease Financial Corporation today to explore what’s possible.