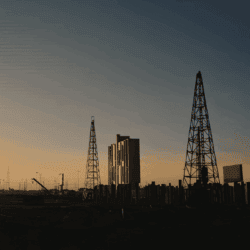

Oil & Gas Equipment Financing That Powers Your Operation

Financing energy-industry assets with flexibility, speed, and industry expertise.

Support for the Equipment Your Energy Business Depends On

Drilling Equipment

Workover Rigs

Compressors

Service trucks

fluid handling

generators & Power

Get your financing in 3 easy steps

Credit application

Signature

Expand your business

Where Oil & Gas Insight Meets Flexible Financing

Financing Built Around Your Business Goals

Oil and gas operations don’t follow a predictable rhythm — and neither should your financing. Traditional lenders frequently rely on rigid criteria, whereas Essex Lease takes a broader view, considering your operational strengths and long-term potential.

What sets us apart:

- Tailored payment structures based on project timelines and revenue cycles

- Fast, direct financing decisions with fewer administrative hurdles

- Options for used and specialized equipment

- Refinancing and sale-leaseback options to free up working capital

Whether you’re supporting field operations, expanding your service capabilities, or upgrading aging assets, our team provides guidance and financing solutions that fit the unique demands of energy businesses.

Power Your Next Project with Confidence

Essex Lease Financial stands alongside oil and gas companies as a financing partner who understands your industry’s equipment needs — and the importance of timing, cash flow, and flexibility.

👉 Connect with our team to discuss energy equipment financing options that help you meet deadlines and achieve your strategic goals.

Looking for the Right Equipment or Need Financing?

Our team is here to help you access the equipment and funding needed to keep your operation growing.

Faster Financing Starts Here

The Answers You Want To Know

We finance a wide range of oil and gas equipment, including drilling and service rigs, pressure pumping equipment, well servicing units, tank trailers, vacuum trucks, generators, and other specialized oilfield assets. Financing can be structured for new or used equipment and tailored to how the equipment is deployed in your operations.

Yes. We understand the cyclical nature of the oil and gas industry. Financing can be structured with seasonal or cash-flow–aligned payments, longer amortizations, or alternative solutions like asset-based lending to help manage volatility while keeping your business moving forward.

When financing oil and gas equipment, lenders look beyond credit scores alone. Key factors include the type and value of the equipment, cash flow, operating history, and the nature of your contracts. This approach allows oilfield businesses to secure financing even when traditional criteria don’t reflect the strength of their operations.