Agricultural Equipment Financing That Works on Your Schedule

From planting to harvest, your operation faces unique timing and cash flow pressures. Our agricultural equipment financing is built to match the realities of modern farming.

In today’s agricultural economy, unpredictable commodity prices, rising input costs, and seasonal cash-flow cycles make it difficult to secure the equipment you need—when you need it. At Essex, we help farmers and agri-businesses access flexible financing solutions that keep operations running strong, year after year.

Flexible Financing for the Equipment Your Fields, Herds and Yields Depend On

Whether you’re managing a family farm, expanding your agri-business, or replacing aging machinery, we’re here to help you finance the new or used equipment essential to your operation. From tractors and combines to grain handling systems, livestock equipment, and specialized machinery, our solutions are designed to support your production goals and improve efficiency.

Combines

Balers

Grain Trucks/Trailers

Livestock Trailers

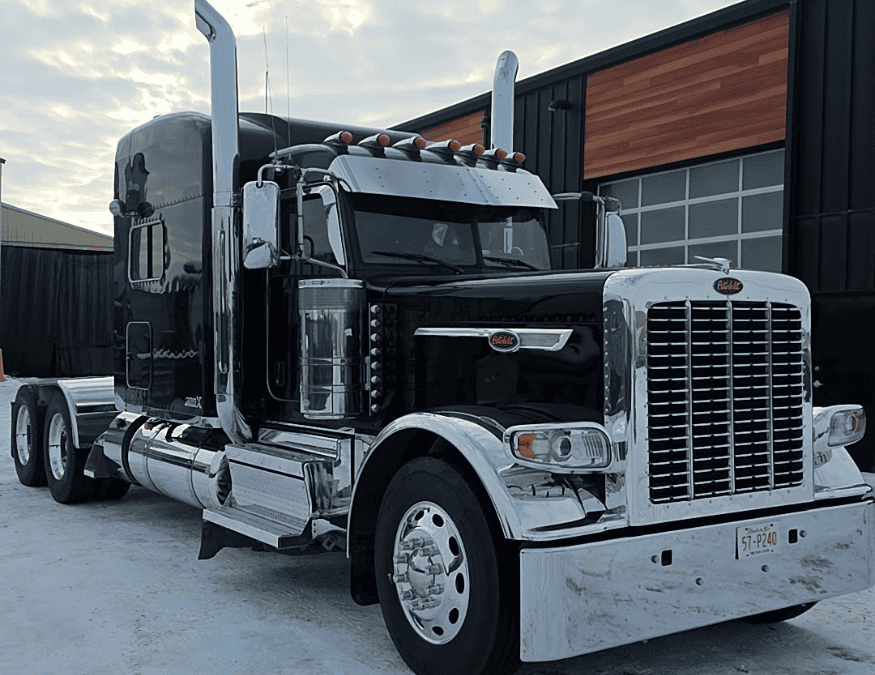

Semi Tractors

Side Dump Trailers

Tractors

Utility Vehicles

Get your financing in 3 easy steps

Credit application

Signature

Expand your business

Where Agricultural Insight Meets Flexible Financing

We Understand Agriculture - Season to Season

Agriculture doesn’t follow standard business cycles. Your busiest season, slowest season, and highest-expense season often overlap—and traditional lenders don’t always understand that. That’s why we take a broader, real-world view of your operation, looking beyond financial ratios and considering factors like crop timelines, equipment utilization, and long-term productivity.

Our goal is simple: to provide flexible, customized financing built specifically for agricultural producers and agri-businesses, especially those underserved by conventional banks. We take the time to understand your operation, the pressures you face, and the opportunities ahead.

Why Agricultural Businesses Choose Essex

- Flexible structures designed around seasonal cash flow

- Fast approvals for time-sensitive equipment purchases

- Financing for new or used equipment across all major brands

- Refinancing options to unlock working capital from existing assets

- A team that understands agriculture, not just financial statements

Looking for the Right Equipment or Need Financing?

Our team is here to help you access the equipment and funding needed to keep your operation growing.

Faster Financing Starts Here

The Answers You Want To Know

No, we’re not a broker. We provide direct financing tailored to meet the unique needs of your business, saving you time and frustration.

With our expertise in the unique needs of industrial companies, we’re able to help you manage cash flow and optimize equipment use.

Our expertise includes:

- Direct equipment financing, leasing, and rental options.

- Flexible working capital loans, lines of credit, and sale-and-leaseback transactions.

- Solutions tailored for startups, mid-sized companies, and expanding businesses.

By partnering with Essex Lease, you get faster approvals, flexible terms, and a relationship-focused approach designed to support your long-term success.

Ag finance through a specialized lender like Essex is often more flexible than traditional bank financing. We focus on:

- Understanding agricultural cycles and seasonal income

- Structuring payments around harvest and operating timelines

- Equipment value and usage, not just financial ratios

This allows us to support businesses that may not fit standard bank models.

Not necessarily. Used farm equipment loans can be a strong solution when the equipment is well-maintained and suited to the operation. Essex regularly finances used equipment and works with you to ensure the structure makes sense for your business.

Approval timelines vary depending on the transaction, but farm equipment financing can often be completed efficiently once the equipment and business details are reviewed. Our goal is to keep your operation moving without unnecessary delays.