Equipment Leasing & Financing Specialists in Saskatchewan

Supporting Saskatchewan Businesses with Simple, Flexible Equipment Financing—No Red Tape, Just Results.

The goal that

drives our success

A Different Approach to Equipment Financing in Saskatchewan

At Essex Lease, we understand the unique challenges faced by businesses across Saskatchewan. From the growing hubs of Saskatoon and Regina to the resource-based communities in Estevan, North Battleford, and beyond, each region has its own economic realities. Unlike traditional lenders that focus strictly on credit scores and balance sheets, we take a broader view—looking at your business’s potential and the local market conditions. Our mission is to provide flexible, customized financing solutions for Saskatchewan businesses, especially those overlooked by conventional banks.

Why Saskatchewan Businesses Choose Essex Lease

Industry Experience

With decades of experience serving industries that drive SK’s economy—like forestry, construction, transportation, and oil and gas—we understand the challenges local businesses face and what it takes to keep operations moving forward.

Dedicated Team

Direct Lender

Tailored Solutions

Our Financing Options in Saskatchewan

Forestry

Preserve your resources and grow your operations with financing solutions for logging equipment, sawmill upgrades, and biomass energy projects.

Construction

Finance heavy equipment like excavators, dump trucks, and Hydro Vac trucks—tailored for SK’s fast-growing construction hubs and equity-backed projects.

Transport

Drive growth with financing for trucks, trailers, and container chassis—new or used. Backed by deep industry expertise and SK’s thriving port economy

Sand & Gravel

Support SK’s resource industries with financing for equipment used in exploration, extraction, processing, and hauling.

The Answers You Want To Know

We offer a range of tailored financing solutions to support the diverse needs of Saskatchewan’s industries—including agriculture, construction, mining, oil and gas, and transportation. Our financing options include:

Equipment Financing – For purchasing, leasing, or refinancing new and used equipment. We finance everything from combines and tractors for farmers in Moose Jaw to haul trucks and loaders for mining and construction companies across the province.

Working Capital Loans – Flexible funding to help you manage cash flow, cover expenses, or seize timely opportunities.

Lines of Credit – Convenient access to revolving funds that support your day-to-day operational needs.

Consolidation Loans – Combine multiple debts into a single, manageable payment and streamline your finances.

Sale and Leaseback Transactions – Unlock equity from your existing equipment while continuing to use the assets in your business.

At Essex Lease, we specialize in helping Saskatchewan businesses that may not qualify for traditional bank financing. With fast approvals, flexible terms, and custom payment plans, we’re here to keep your business moving forward.

We’re not a broker—we provide direct financing tailored to the specific needs of your business, saving you time and eliminating unnecessary complexity.

With deep experience serving Saskatchewan’s key industries, we understand how to help you manage cash flow, optimize equipment usage, and keep operations running smoothly.

Our expertise includes:

Direct equipment financing, leasing, and rental options

Flexible working capital loans, lines of credit, and sale-and-leaseback transactions

Custom solutions for startups, mid-sized companies, and growing operations

When you partner with Essex Lease, you get faster approvals, flexible terms, and a relationship-driven approach built to support your long-term success.

At Essex Lease, we know that every Saskatchewan business is different. While we do review your financial history, we also take a broader view—considering your goals, values, and long-term plans.

Interest rates and down payment requirements vary depending on your specific financing needs and business circumstances. We offer flexible, customized terms that align with your cash flow, operational demands, and industry realities.

Our goal is to work with you to create a financing solution that fits—not one built on rigid requirements or one-size-fits-all formulas.

Yes. We understand that industries like agriculture, construction, oil and gas, and mining often experience seasonal cash flow cycles or project-based revenue. That’s why we offer flexible financing terms—typically ranging from 24 to 84 months, and in some cases, up to 96 months.

For agricultural and seasonal businesses, we also provide seasonal payment structures to better match your income cycles. Our goal is to tailor your financing to your business realities—not the other way around.

Yes. At Essex Lease, we understand that not every business has a perfect credit history. We work with Saskatchewan businesses across a wide range of credit situations to find financing solutions that support growth. Our flexible, common-sense approach means you still have options—even if the banks have said no.

Yes. Whether you’re purchasing equipment from a private seller or sourcing it from outside Saskatchewan, we can help. Our team will work with you to structure a financing solution that fits your needs and ensures a smooth, secure transaction—no matter where the equipment is coming from.

What our clients say

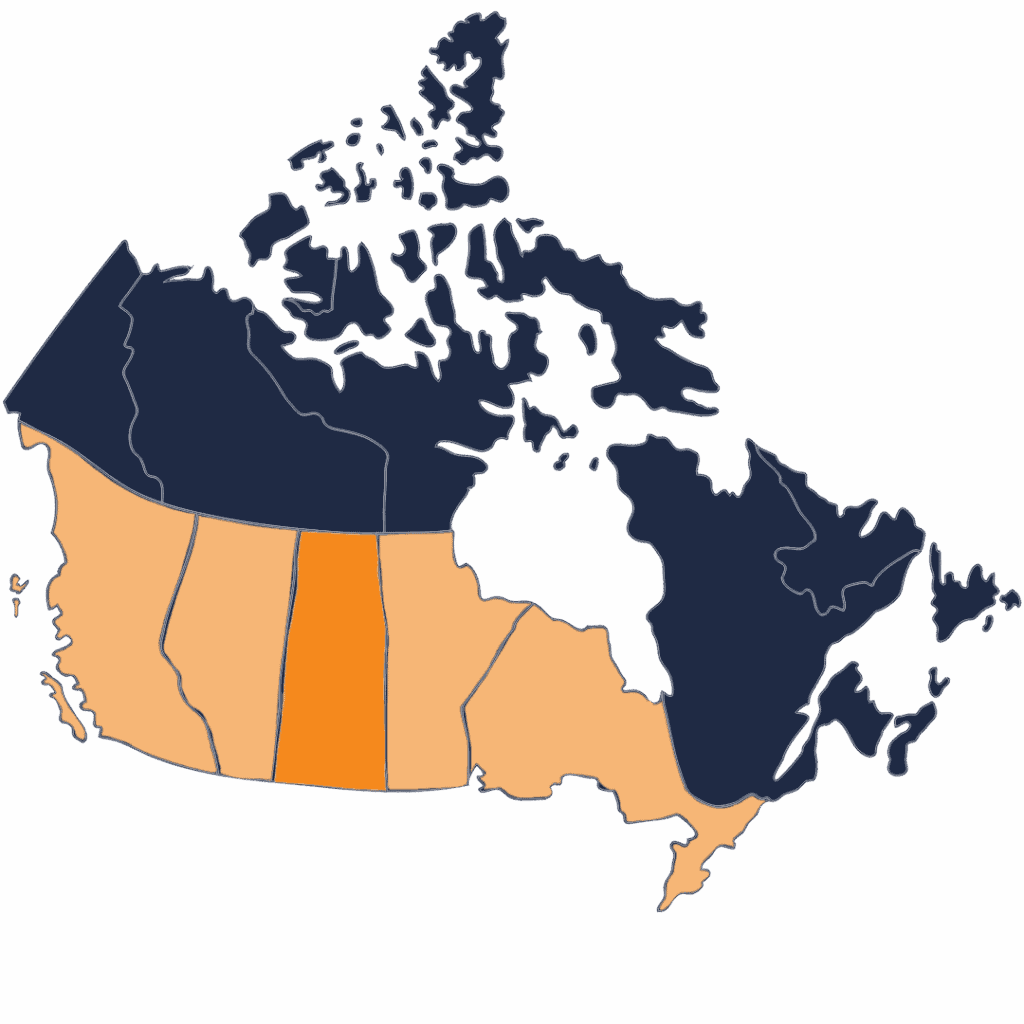

Get the Essex Advantage from BC to Ontario

At Essex Lease, we’re more than a lender; we’re your partner in navigating the unique business environment of Saskatchewan. Reach out today to discover how we can support your growth in this dynamic province.