Equipment Leasing & Financing Specialists in Alberta

Helping Alberta Based Businesses Secure the Right Equipment with Easy, Hassle-Free Financing.

The goal that

drives our success

A Different Approach to Equipment Financing in Alberta

At Essex Lease, we understand the unique challenges businesses face across Alberta. From the vibrant cities of Calgary and Edmonton to the resource-driven communities in Red Deer, Fort McMurray, and beyond, every region has its own distinct needs. Unlike traditional lenders who focus only on financial statements, we take a broader view—considering your business’s potential and the realities of the local economy. Our goal is to deliver flexible, customized financing solutions designed specifically for Alberta businesses, especially those overlooked by conventional banks.

Why Alberta Businesses Choose Essex Lease

Industry Experience

Dedicated Team

Direct Lender

Tailored Solutions

Our Financing Options in Alberta

Forestry

Preserve your resources and grow your operations with financing solutions for logging equipment, sawmill upgrades, and biomass energy projects.

Construction

Finance heavy equipment like excavators, dump trucks, and Hydro Vac trucks—tailored for AB’s fast-growing construction hubs and equity-backed projects.

Transport

Drive growth with financing for trucks, trailers, and container chassis—new or used. Backed by deep industry expertise and AB’s thriving port economy

Sand & Gravel

Support AB’s resource industries with financing for equipment used in exploration, extraction, processing, and hauling.

The Answers You Want To Know

We offer a variety of tailored financing solutions to meet the unique needs of Alberta’s industries—including oil and gas, agriculture, construction, mining, and transportation. Our financing options include:

Equipment Financing – For purchasing, leasing, or refinancing both new and used equipment. We finance everything from heavy-duty trucks and trailers for transportation companies in Edmonton to drilling rigs and loaders for energy and construction operations across the province.

Working Capital Loans – Flexible funds to help manage cash flow, cover operational costs, or jump on time-sensitive opportunities.

Lines of Credit – Convenient access to revolving funds that support your day-to-day needs without the delay of reapplying.

Consolidation Loans – Combine multiple debts into one streamlined payment to simplify your finances.

Sale and Leaseback Transactions – Access the equity in your existing equipment while continuing to use the assets in your operations.

At Essex Lease, we specialize in helping Alberta businesses that may not qualify for traditional bank financing. With fast approvals, custom payment structures, and flexible terms, we’re here to keep your business moving forward.

We’re not a broker—we provide direct financing designed around the specific needs of your business. That means fewer delays, less red tape, and more control over your financing experience.

With deep experience in Alberta’s key industries, we help businesses manage cash flow, maximize equipment usage, and stay competitive in a fast-moving market.

Our financing solutions include:

Direct equipment financing, leasing, and rental options

Flexible working capital loans, lines of credit, and sale-and-leaseback transactions

Custom options for startups, mid-sized businesses, and companies looking to grow

When you partner with Essex Lease, you get faster approvals, flexible terms, and a relationship-first approach focused on your long-term success.

At Essex Lease, we know that no two Alberta businesses are the same. While we review your financial history as part of the process, we also look beyond the numbers—factoring in your goals, values, and long-term vision.

Interest rates and down payment requirements vary depending on your specific financing needs and business profile. We offer flexible, tailored terms designed to align with your cash flow, industry realities, and operational priorities.

Our focus is on finding a solution that works for you—not forcing your business into rigid formulas or bank-style requirements.

Yes. We understand that industries like oil and gas, agriculture, construction, and transportation often deal with seasonal cash flow cycles or project-based income. That’s why we offer flexible financing terms—typically ranging from 24 to 84 months, with options extending up to 96 months in some cases.

For agricultural and seasonal operations, we provide customized payment schedules designed to align with your revenue cycles. Our goal is to shape your financing around your business realities—not the other way around.

Yes. At Essex Lease, we know that a less-than-perfect credit history shouldn’t hold your business back. We work with Alberta businesses in a variety of credit situations to find practical financing solutions that support your growth. Our flexible, commonsense approach means you still have options—even when traditional lenders say no.

Absolutely. Whether you’re purchasing from a private seller or sourcing equipment from outside Alberta, we can help. Our team will structure a financing solution that fits your needs while ensuring a smooth and secure transaction—no matter where the equipment is located.

What our clients say

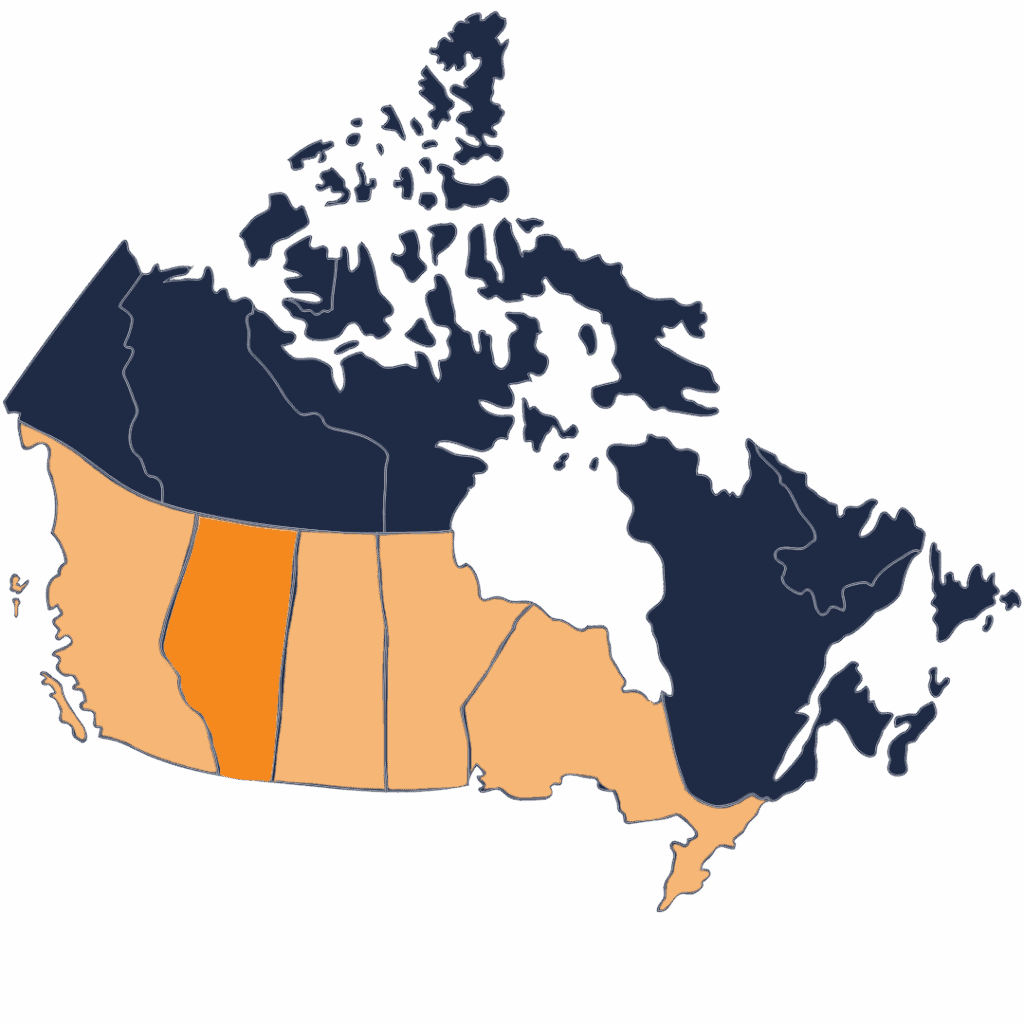

Get the Essex Advantage from BC to Ontario

At Essex Lease, we’re more than a lender; we’re your partner in navigating the unique business environment of Alberta. Reach out today to discover how we can support your growth in this dynamic province.